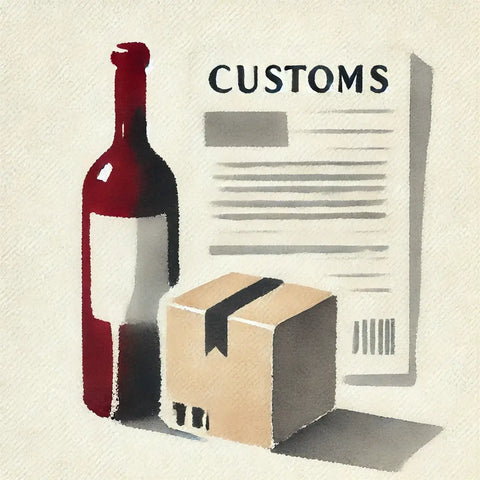

Australia – Importing Wine Regulations

While we typically manage duties and tariffs for most markets, for the Australian market we are unable to do so. Should additional fees be applied under these circumstances, they will be the responsibility of the importer.

For orders under $1,000 AUD in exwork price*, wine imports are generally tax and duty free.

However, in some cases, the customs office may apply a CIF* tariff instead of Exworks pricing.

When this happens, the following fees might be charged:

Customs Duty: 5% of the wine's *CIF value.

Wine Equalisation Tax (WET): 29% of the wine's wholesale value.

Goods and Services Tax (GST): 10% of the total value of the goods, including Customs Duty and WET.

For further information, please check with your nearest duty offices.

*CIF (Cost, Insurance, and Freight):

This pricing model includes the cost of the wine, insurance during transit, and freight charges up to the destination port.

*Exworks (EXW):

Price applied of the goods.

Fast Delivery

Fast Deliverywith Anti-Breakage Packaging

Chosen and Guaranteed by Professional

Chosen and Guaranteed by Professional Tasters

24/7 Customer Service

24/7 Customer Service

Do you have any other questions?

We're here for you 24 hours a day, 7 days a week. Our dedicated support team is always on call to assist with any inquiries or concerns you may have.

Want to find out more about wine?

Stay up to date and discover more about the world of Italian wine